Towards the end of January 2021, there came stock market turbulence that caused the largest mass stock sell off since the onset of the COVID-19 pandemic. It was months of behind the scenes organizing on a subreddit platform that led to the economic fallout that devastated hedge funds. However, it is not the wins or losses in fiscal totals that interest me— it is the development of a new Marxism within the r/wallstreetbets subreddit that warrants a second glance.

For more information on how this market volatility happened, consider watching this video, it tackles the impact of redditors short selling. In summary, by short selling, a group of individuals were able to artificially inflate prices for meme stocks such as Blackberry, Nokia and, most notably, GameStop.

How did we reach the point in which people are willing to collectively organize online against hedge funds? Within this article, I theorize that this organizing was a direct response to the Covid-19 pandemic and the federal government’s responses to financial hardship of individual consumers. I will conclude with predictions for how this moment might impact stock market volatility in the future.

Looking Deeper into R/wallstreetbets

Davie’s J Curve predicts that those who perceive themselves as experiencing injustice, regardless of actual experienced injustice, are more likely to organize. Thus, in December 2020 as Congress discussed and House Republicans subsequently blocked a proposal to send a second wave of $2,000 stimulus checks, instead settling to provide $600 in aid to individual tax filers— the subreddit was plastered with posts about their perceived losses. This same $900 billion relief bill was intended to support small businesses and was taken advantage of by public corporations. Therefore, the J-curve is fulfilled in that individuals expected more government support and did not receive it. Therefore, there are two individuals that can be diagnosed as the problem: our government or the big business they are backing.

Additionally, redditors on R/wallstreetbets had grown tired of Wall Street hedge funds, like Citron Capital and Melvin Capital, betting against the stocks of plummeting companies. Citron and Melvin both did this in hopes of profiting off of the company’s loss, so they will be able to lend the stocks to other investors, then buy them back for even cheaper prices. Thus, they can profit off of the difference in the prices they sold the stocks for and the bought price.

In response to the short squeeze conducted by Wall Street’s largest hedge funds, R/wallstreetbets has grown into a community of investors that want to bet against big corporations.

How R/Wallstreetbets Has Changed The Political Landscape

I have high hopes for the Robinhood debacle being a gateway for some entry-level traders into an understanding of class relations. I, like thousands of others, have become one of the subreddits’ daily visitors. While visiting I have made a few astute observations.

Witnessing events over the past few months, there has been a transformation in the narrative redditors use to talk about themselves. They went from being focused on winning out against one another, into community solidarity. This past week, a moderator chimed in to remind everyone “This is going to be the biggest transfer of wealth the world has ever seen, don’t ruin it being a paper hand and selling low.” Then- U/ Aydenn7 closed with “THIS IS NOT A GAME OF GREED. IT IS A GAME OF TRUST.” When the subreddit was formed in 2012, it focused on wins and losses each took against each other in positions.

Now, “loss porn” is celebrated as if traders losing out are heroes to the cause. These individuals, fronting a majority of the losses, are sustaining the movement and bring in more individuals. Their goals are not to win and lose against each other in the short term. The current goal is to build trust and redistribute wealth to across the subreddit. This recognition, I argue, is edging the subreddit towards class consciousness, as individual traders realize that the stock market is unwelcoming to the individual. Multiple redditors have harkened back to the French Revolution stating “Let’s just say there has been historical precedent for an abused population who is tired of the abuse. Don’t just let them tell you to eat cake. This is NOT violence advice, but don’t just go quietly into the night”(u/stenbuck). These individuals recognize that in response to the squeeze, the amount of shorts likely increased over 200 percent for GME. That is an attempt to devalue stock and cause mass sell off to bring prices back towards traditional levels. If this attempt fails, this could cause widespread market volatility.

However, redditors are unwilling to allow a return to the status quo. Even as individuals claim reddit is not political.

Wallstreetbets has not and will never be just one individual, rather a collective of ideals and goals greater than the sum of its parts. Reddit is the soapbox that allows these diverse individuals to amplify messages that resonate with them with their votes. That does not mean this is political — Wallstreetbets has never and will never be political. – Reddit U/ Anonymous Moderator 1

There is clear recognition of redditors being on the side of increasing accessibility to the market and decreasing wealth hoarding. Therefore, moderators can label the movement as nonpolitical, but their language does not negate their actions.

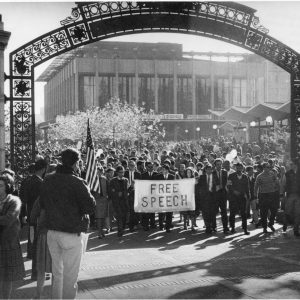

Featured Image Source: Flickr

Is This The Next Occupy Wall Street?

Let us begin with why it might be the next Occupy Wall Street. There are central themes in the framing for both movements. They both utilize diagnostic framing to point towards corporate entities as the main cause of grievances. This framing makes sense as Occupy Wall Street was formed in the wake of the 2008 recession and r/wallstreetbets came into power during a time of financial hardship caused by the covid-19 recession.

The two movements focused heavily on motivational framing and projecting themselves as individual actors of a common cause. Whilst the precise goals differ, their calls-to-action are simple. Occupy Wall Street coined the slogan, “We are the 99%,” and Reddit shares those similar feelings. This quote from one of the subreddits moderators captures the sentiments of Occupy Wallstreet’s original claim:

Memes aside, things have been shitty for individual traders. Recent events have highlighted how skewed the game has been towards institutional traders. Whether or not there was any intentional wrongdoing, the inherent biases for a hedge fund being bailed out by another hedge fund and ALSO being a major contributor to a large portion of a brokerage’s earnings is kinda fucked up. While I’m not smart enough to say whether the game is 100% rigged, it certainly doesn’t look good. The US government breaks up monopolies for this very reason, don’t they? – Reddit U/ Anonymous Moderator 2

The overall goal to “rescue GameStop stock, punish certain industry practices, and, above all, troll the stock market” echoes Occupy Wall Street’s goal of undermining the typical avenues capitalism uses to maintain Wall Street’s economic power (Joe McCarthy, 2021). This defiance hints at the ability for widespread organizing to increase market volatility and further undermine the system.

The social media movement was born with Occupy Wall Street (OWS) as their website became a hub for information regarding protest actions and demands. The concept piloted by OWS relied on loose social ties to bring in more activists and used nonviolent protests as a way to ensure movement growth over time. Media coverage of the movement grew in response to peaceful protesters being beaten and arrested by the police.

The movements are also similar in the demographic they attracted. The narrative these movements tote of being the people against the proverbial big man politics of Wall Street is flawed in that both of these groups were composed of majority young men. Based on field research done during the 2011 Occupy Movement, it was found that 81.2 percent of protestors were white and 61 percent identified as male. In a R/wallstreetbets conducted study in 2017, it was found that nearly 98 percent of individuals on the subreddit were men and 92 percent were under the age of 34. While ideologically this makes sense, as young people are statistically found to be more left leaning and socially radical, it is interesting to note the differences between the narrative of “the 99%” versus the actuality of over 90 percent college educated and majority white students.

However, these two movements differ in that they have drastically different prognostic frames through which they gather support. Prognostic frames are the framing component that unites individuals through their loose network ties and moves them forward by establishing a collective goal. The importance of a collective goal is that it allows for the strengthening of these weaker social media ties and gives individuals collective stake in the outcome of the movement. Occupy Wallstreet’s prognostic frame was a series of planned protests to showcase how upset “the 99%” were. Yet, on a national scale, the movement was fragmented on how to carry out this vision. That is why there was a quick fizzle out in terms of motivation around the movement. R/wallstreetbets differs in its approach because it has a straightforward collective goal of buying more shares until there is a buyout from hedge funds covering their shorts.

Perhaps that can explain why these groups are prone to social movement building. College educated white adults expect fair treatment by the government more so than people of color and low-income individuals. They also believe that mystical markets, such as the stock market, should be accessible to them.

Why Does This Matter?

Even as R/Wallstreetbets and Redditors claim to not be a political movement, there is evidence among leadership and followers of anti-institutional views:

The financial system has always been shrouded in mystery and complexity, on purpose, to keep the golden goose beneficiaries entrenched. We’ve especially seen it in action the last few weeks, where fairness and the now apparently idealistic thoughts of a level playing field have gone out the window as traders’ control of their own investments was wrested from them. We see the users, we see the quality of the content, and we’re here to evangelize on your behalf. The struggle will be long and arduous. But we’re in it if you’re in it with us. Let’s get it done you amazing degenerates. – Reddit U/ Anonymous Moderator1

There has been joking mention in passing on the subreddit about this moment of stock volatility being “shake-down economics.” This new term, coined as a joke in reference to the “big apes” (as high market investment retail traders call themselves) climbing the metaphorical tree for bananas and violently shaking enough down that the little apes get more than enough to eat too.

Shake-down economics is a riff off of the Reagan-era concept of trickle-down economics where providing tax cuts to the rich will allow for job stimulation and economic growth overall. This response to Reaganomics centers the idea that the wealthy, in this case hedge funds, will not provide for low-income investors. Therefore, it is up to those within the community to create circumstances under which more “apes,” big and small, can figuratively eat.

I admire the creation of this new term, as it hinges on wealth redistribution to the many being facilitated not by public business or government funded tax breaks; instead it is a move towards modern day Robinhood.

What Happens Next?

In a world where we have experienced both of these moments, we are left with one question. I am not convinced this movement is the next Occupy Wall Street because these groups are motivated by possible individual gain rather than a revolution of the 99%. However, this moment is a pivotal step in the move towards wealth redistribution. These Redditors may have been suppressed by Robinhood, but the meaning is not lost. Thus, the question I am left with is how can we use this momentum and movement to create massive shifts in wealth from the 1% towards those in need.

These Reddit vigilantes are engaged in modern-day Robin Hood acts of giving to those in need. Under the guise of a free for all, they have showcased the power of social media to weaken the power of Wall Street.

“So what now? We have an opportunity to change the game. We need to move away from a system with power in the hands of the few to one where power is in the hands of the many.” – Reddit U/ Anonymous Moderator 3

There are a few important reasons for why this moment/movement matters. One of these reasons revolve around AOC and Ted Cruz being on the same side politically. They both called for investigations into Robinhood shutting down orders of GME along with other meme stocks in reaction to the high volatility of the market. That is because, if accessible platforms close trading to the masses while the “hedgies,” as Redditors call them, can continue to trade, it can stimulate mass sell off and manipulate the market.

The age range of 18-26 year old Redditors watched their parents struggle through the 2008 recession. Last month, they made a choice to combat the corporate greed evident on Wall Street. Regardless of the message and individual financial setbacks, I think the positive reinforcement individuals received through media publicity, development of community ties and some redditors personal financial gains; correlates directly to the future likelihood of increased market volatility.

This prediction is informed by the opinions of multiple leading economists. Jason Reed, a finance professor at the University of Notre Dame, reported to CNBC that he believes the reddit movement will continue. This is due to this form of market investment tactics being difficult to regulate. James Angel, a finance professor at Georgetown University’s McDonough School of Business, argues that while this does showcase the faultiness of the market structure “the real question is what, if anything, should be done about it.”

What was done about it? So far, the House Financial Services Committee held a hearing interrogating the CEO’s of Reddit, Robinhood, Citadel, Melvin Capital and reddit user U/DeepFuckingValue. While Robinhood was the focus of interrogations, nothing concrete came of the investigation. There will be independent investigations held by the Securities and Exchange Commission, along with the Senate Banking Committee. The SEC chair and SBC have made few comments on what their intentions are for their upcoming hearings.

Therefore, my argument rests in that nothing will be done about the effect small investors can have on the stock market as a whole. Corporate lobbyists work diligently to ensure there is deregulation of the stock market, this fallout is due in part to how unregulated the industry is. Thus, regardless of if the movement leads to increased regulations, there is no returning to the status quo.

Even if this movement isn’t Occupy Wallstreet 2.0, it does indicate a class awakening. Gamestop’s slogan, “Power to the Player,” represents this modern shift towards empowering individuals to fight back against the rules put in place by the corporations running the game.

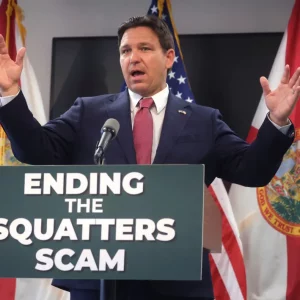

Featured Image Source: Kakuchopurei

Comments are closed.