In 1842, Charles Darwin referred to the Belize Barrier Reef as “the most remarkable reef in the West Indies.” With its gleaming turquoise waters, verdant clusters of mangroves and rainbow of brightly-colored coral rising from the seafloor, it is plain to see why. In addition to its aesthetic appeal, the site is home to multiple endangered species, from manatees to crocodiles, and it is a popular location for tourists to snorkel and scuba dive. In November, Belize took a new step towards protecting this complex ecosystem: a “blue bond.”

The transaction, which will allow the Central American nation to restructure US$553 million of its debt in exchange for more expensive protection of its oceans and reef, took place through the contributions of multiple parties. The Nature Conservancy (TNC), the largest environmental nonprofit in the Americas by some measures, arranged the deal with the U.S. International Development Finance Corporation, which provided insurance, the bank Credit Suisse, which arranged the financing of the bond, and Belize’s government, which will use the loan to purchase its commercial debt and fund conservation efforts. Ultimately, over the course of the next 20 years, the deal will generate an estimated US$180 million for conservation.

Though impressive in its commitment to preserving marine ecosystems, which are crucial both to biodiversity and the needs of local communities, the concept of a debt-for-nature swap is nothing new. These arrangements have existed since at least the 1980s, gaining traction in the wake of the Latin American debt crisis that plagued countries from Mexico to Argentina. Around the same time, environmental issues had risen to the fore of the public attention, including accelerated destruction of tropical rainforests. Many onlookers feared that these would worsen, since the Latin American governments that sought to fight debt by cutting government spending may have cut environmental protection programs. Hence, debt-for-nature swaps seemed like a panacea to address the joint concerns of severely indebted developing countries and environmental degradation.

As debt-for-nature swaps became more popular, they took on different forms. Early on, most transactions were trilateral, or three-party swaps. A non-governmental conservation organization (NGO) would purchase debt at a discounted rate, renegotiate it with the debtor country and then sell it back at more than what the NGO paid for it yet less than it cost on the market. The difference is paid, in local currency, to conservation funds, which are administered by the debtor government, the NGO and other environmental groups. Later on, the United States moved more towards bilateral swaps, authorized under the Enterprise for the Americas Initiative. In these transactions, the creditor government reduces a certain amount of debt and, in exchange, the debtor government sets aside a quantity of funding for environmental projects. Finally, in 2001, TNC and the United States pioneered a new kind of debt-for-nature swap in Belize called a subsidized swap. Following this method, an NGO matches 20% of a federal government contribution to a developing country to reduce debt and fund conservation.

Debt-for-nature swaps have recently declined for various reasons, including lower appropriations by the United States as well as other options for debt relief becoming available for developing countries. However, in the wake of the COVID-19 pandemic and the associated economic turmoil, there has been renewed discussion regarding their potential. For example, Belize was prompted to engage in its recent ocean protection endeavor at least in part by an 85.5% decrease in overnight visitors between January 2020 and January 2021. Thus, as countries look to the past for ways to rebuild their economies, it is possible that debt-for-nature transactions could see a resurgence. But if debt for nature swaps are to assume an increased prominence today, then it is essential to consider the lessons of the past. How effective have debt-for-nature swaps proven to be at achieving either their economic or environmental goals?

The results have been mixed. Advocates point out that the conservation funds generated are considerable, particularly when compared to what the country would otherwise have dedicated to preserving its environment. However, critics argue that these programs fail to accomplish much in the way of debt reduction. What is more, swaps can raise enforcement issues on one side and national sovereignty on the other, and it can be difficult to mediate between these competing interests. Finally, and critically, there is the matter of the rights of Indigenous communities to their land, which have been flagrantly disregarded in the past. The first debt-for-nature swap, which occurred between Bolivia and the NGO Conservation International (CI), exemplifies many of these issues. Enforcement was poor, nationalist outrage arose when the news inaccurately reported that CI had acquired the title to protected forests and the Indigenous Chimane were largely ignored even as the new environmental policies impeded their way of life.

In consideration of these past shortcomings, governments and NGOs should strive to craft debt-for-nature transactions that are focused, feasible, and transparent. The initiatives must be multilateral, with involvement of both environmental representatives and local communities, and the needs and voices of Indigenous communities must be respected throughout. If properly planned and monitored, they can be effective strategies that facilitate international cooperation for environmental security while simultaneously advancing development needs. Additionally, as development recovers across the globe, there is potential for new nations to enter the field of debt-for-nature swaps. Some hope, for instance, that China may step up to offer these exchanges. Chinese banks loaned $43.5 billion to Latin American and Caribbean countries between 2015 and 2019, and the crises induced by COVID-19 will likely make it difficult for these nations to pay off what they owe.

Although proponents must be cautious not to overstate the degree to which debt-for-nature swaps can reduce the economic struggles of debtor countries, they can still make measurable strides in improving the credit standing and easing the debt burdens of these nations. Furthermore, the protection of ecosystems such as tropical forests and coral reefs is critical not only to conserve threatened species but also to enhance climate security, particularly for small island nations facing both high levels of debt and rising sea levels. As the planet approaches untenable levels of climate change, the role that debt for nature swaps can play is twofold. On one hand, they can ameliorate the situation by preserving essential carbon sinks, which counter the greenhouse effect produced by anthropogenic carbon emissions. On the other hand, by providing developing countries with conservation funding, they can mitigate the damage wrecked by those changes that have already taken place. Belize’s blue bond plan, for instance, will “enhance social and environmental resilience to climate change impacts in coastal communities,” according to Julie Robinson, TNC’s Belize Program Director.

The recent COP26 summit both emphasized the urgency with which nations must act to address climate change and highlighted the glaring divisions between them. In the midst of the constant conflict and negotiation, debt-for-nature swaps offer an innovative solution to such challenges by mediating environmental and economic interests, countering the idea, too often taken for granted, that these concepts are inherently oppositional.

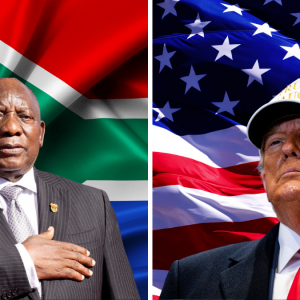

Featured Image Source: BBC News

Comments are closed.