Investing in cryptocurrencies is advertised like a trip to Vegas—are you going to win big or blow it all? While this concept glamorizes and attracts many potential investors, it is just glamour. At best, investing in both cryptocurrencies or NFTs is like supporting your local Herbalife distributor and joining at the bottom of a pyramid scheme.

Cryptocurrencies and Non-Fungible Tokens, or NFTs, have garnered attention from people worldwide. The promising new tech has people who have never been interested in finance and investing now spending thousands on it in hopes of getting rich quick. With all the hype surrounding huge payouts everyone is hoping they invest in the next Bitcoin, but with this comes those ready to exploit and take advantage of an unregulated market.

The Blockchain

Cryptocurrency, or crypto, is best described as a digital token—similar to an arcade token, where one would pay real, tangible money in exchange for a coin. Currently, there are tens of thousands of different types of crypto on the market with some of the biggest names incluing Bitcoin, Etheruem and a ‘meme coin’ known as DOGEcoin. ‘Meme coins’ are cryptocurrencies that were either started, based or invested in as a joke. DOGE had been started to make fun of other digital currencies, trading for less than a cent and then later heavily invested into as a joke topping its value at 74 cents, approximately worth 100 times more than its original price.

These cryptocurrency trades take place within the ‘blockchain,’ a decentralized system that records all transactions. It is essentially a network of computers keeping records without the involvement of a third party like the government. The lack of third-party involvment makes the use of blockchain very appealing as a method of data collection that can’t be altered where all transactions are verified among a network of computers.

One of the newest uses of the blockchain has been NFTs. NFTs are essentially a way to show digital ownership that is verified on the blockchain. They differ from crypto as they are “non-fungible” or non-exchangeable, as opposed to traditional, or fungible currency, like a dollar bill, one bill will always be worth or exchangeable at equal value to any other dollar bill, NFTs on the other hand are each unique and are not equivalent to one another. NFTs have a large appeal in many industries with art and trading currently dominating the market. For artists, creating digital art with their own name encrypted onto it would prove the authenticity of the art itself, allowing the artist control of their own work. Some of the most expensive NFTs have been sold due to their collectibility. For example, CryptoPunks are “10,000 unique collectible characters with proof of ownership stored on the Ethereum blockchain,” with its most expensive character, #3100, selling for $7.58 million dollars.

Everything about blockchain is new and surrounded by “hype.” Everyone wants in and to be part of the next big thing to cash out on top. Every day more information and case studies come out about blockchain, crypto, and NFTs. Everything is so new and many of those interested don’t understand all the facets of this new technology. Something as promising as blockchain is slowly getting tainted by people looking for easy money without fully understanding what they’re buying into.

The Pyramid

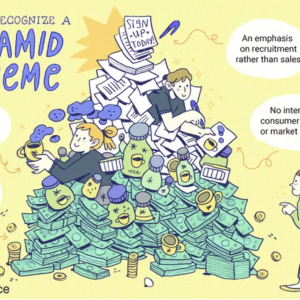

Multi-level marketing schemes, also known as MLMs, form a pyramid-shaped workforce structure just like a classic pyramid scheme. This pyramid shape describes companies where workers recruit more workers in fanning out levels, and, at MLMs, each worker earns by selling product, not by earning a salary. “Pyramid Schemes” are systems where a company relies more on recruiting members to sell products than selling their own products, and will fail if employees don’t recruit a certain number of new employees.

According to the Federal Trade Commission, while a company can operate legally as an MLM, pyramid schemes are considered illegal. The distinction between the two is that non-pyramid schemes “will pay you based on your sales to retail customers, without having to recruit new distributors.”

Many pyramid schemes work off the idea of getting rich quick. When recruiting new members, distributors will sell those on the idea of kissing your current life goodbye, quitting your job, and making millions from home. Once recruited, you are in your recruiters’ down-flow and the better you do, the more money they will make. While some incentivize distributors to sell products, many heavily emphasize the recruitment process. The more people you can get involved, the better. Systems structured around recruitment as the main basis of compensation cannot succeed: if each member must recruit 2 more members each cycle for the company to survive, after 33 recruitment cycles, everyone on Earth would have to be an employee.

Famous pyramid schemes, including companies like Mary Kay, Herbalife, and Amway, have all denied claims of being pyramid schemes due to language technicalities but each have prompted large FTC investigations. All of these companies continually deny these claims but are open about the fact that recruiting is essential to the success of their company. Those at the bottom of the pyramid, or the newer recruits, make significantly less than those at the top. In Herbalife’s case 89% of their distributors earn no profit from the company at all.

At the core of these schemes are those at the top preying on people who need or want money quickly only to exploit and profit off their work or investment.

The Problem

Where pyramid schemes and cryptocurrency intersect is the concept of pump and dumps. Pump and dumps, or common market manipulation fraud, have been polluting the crypto market and have put into question the validity of crypto at all.

In traditional stock investing, pump and dumps are when con artists intentionally offer recommendations to buy stock based on false or misleading information. They use these artificially increased sales to boost a stock that those running the scheme have already bought into at a low price. Once the stock increases, the initial investors sell their stock at a high price, leaving everyone else who bought with a stock that will only go down, since its value was manufactured, not real. This method of investing is supposed to be illegal, where anyone caught practicing this method is subject to heavy fines.

However, in the world of crypto, lack of adequate regulation has allowed for massive pump and dump schemes on a huge, and widely public scale. Over the summer, internet influencers and personalities pushed a cryptocurrency known as ‘Save the Kids Coin’ ($KIDS). Advertisers included several members of a professional E-sports and entertainment organization, FaZe Clan, and other notable celebrity influencers on Twitter and other platforms. After a significant portion of their fans had decided to invest, the influencers’ digital wallets showed that they had sold all their coins once the value had been driven up.

In these modern pump and dump schemes, those at the top hold a lot of influence and can control what their army of idolizing fans do or say. People might join earlier thinking they can earn as much as the celebrities and will then benefit from having more people buy into the coin, but no one will make as much as those involved in the initial creating and pushing of the token, and many lose everything.

If not the influencers themselves pushing the tokens, coins like ($SQUID) based on the popular Netflix show Squid Game, rely on combining the hype around pop culture with the eagerness some have to get involved in crypto. The scammer who made ($SQUID) made $2 million dollars in earnings after the coin jumped from a single cent to over $2,000 and then back to just a couple of cents in a matter of minutes.

Through this method, a modern pyramid scheme takes form, meaning the next generation of scams and get rich quick schemes are going to move away from cosmetics and protein powders and towards the blockchain.

As for NFTs, exclusivity and FOMO run the game—everyone wants in and where there are winners, there are losers. NFTs, in many cases, are the incentive to get people to buy coins and therefore pump the value. The value of coins only increases when the demand for the coins increases, because of this new ideas are needed to keep demand not just consistent but growing. NFTs became an incentive for people to turn in their real world money for digital currency. To make the tokens desirable, NFTs had to push their identity as a one-of-a-kind, exclusive, membership into the club. In some cases this “club” is metaphorical, you bought one and now you are “in.” In other cases, it is very literal. The Bored Ape Yacht Club, or BAYC, is responsible for images like this:

These are images which are quite literally selling “a limited NFT collection where the token itself doubles as your membership to a swamp club for apes.”

Because continual growth is necessary to maintain the desirability and value of crypto and therefore NFTs, when the growing value of these coins inevitably starts to slow, the owners of these NFTs will look for the safer option of selling while on top instead of holding on and losing assets. NFTs are a by-product of the perpetual excitement needed to fuel the crypto economy, everything has to be the “next big thing” and every new use of blockchain has the potential to make anyone millions.

The Solution

Despite the crypto market currently being worth over $3 trillion dollars, there has been little to no government involvement in regulation and protection for those who choose to invest. Issues in how people had begun to interact with the market only seemed to catch the government’s eye when the investments moved away from crypto and towards stocks.

The most notable being the short selling of $GME, or GameStop, in early 2021. After which the Chairman of The Security and Exchange Commission, or SEC, Gary Gensler had addressed Congress voicing concern for the lack of governance in the stock market.

With “meme stocks” like $GME, crypto, and NFTs social media drives their meteoric ascents. While social media excelled in making investing more accessible to the general public with platforms such as Reddit and Twitter becoming hotspots for financial discussion, they also became breeding grounds for market manipulation. When $GME exploded this past spring it finally caught major government institutions’ attention yet no considerable progress has been made to prevent similar future instances.

While $GME is a stock, many of the same players are involved in pushing the stock that influences those at the head of the crypto pump and dumps. The events that transpired inspired entire generations of people to exploit the lack of regulation in the market and “get back” and the hedge funds and backs that normally run the show.

In this gaping hole left ignored by the government, a digital wild west has formed as the FOMO of missing out on the next big investment like $GME has prompted hundreds of thousands of people to take to their Discord groups and Reddit accounts

In the SEC’s regulatory agenda for 2021, there was no mention of any efforts to regulate cryptocurrency. Many issues come from the SEC being limited due to it being an American entity, leaving it little to no jurisdiction in many major coins, including Bitcoin. Other issues in the regulation include the government trying to walk the line between free speech and market manipulation, something that gets tricky when scrolling through Reddit forums giving illicit financial advice and “schemes.”

What is being done with these schemes is happening publicly with evidence of everyone who is responsible widely available online on their own social media platforms. Despite the ample proof of pumping and dumping and market manipulation, nothing is being done in the next year even though there are already precedents set for these same actions being illegal in a non-digital context. Until the government of not just the United States, but every country with access to this technology starts to work towards protecting investors, no one should feel comfortable aimlessly betting thousands to the newest coin you see on social media.

Until governments take action to protect their citizens, investors need to be smarter and need to remember: by the time you hear about it on Twitter, it is probably too late.

Featured Image Source: Image Edited by Alexis Mariash, Original Image from iLeon.com

Comments are closed.