The very essence of the American Dream is under threat today—Wall Street private equity groups are buying up the land rights to entire communities while our foreign adversaries are gaining ownership over hundreds of thousands of acres of American farmland. If our nation continues down this path we will cease to be a nation of owners and entrepreneurs, but one of renters, subject to the will of foreign tides.

The promise of our country relies on the idea of that “white picket fence,” the ability to own land and pass it down from generation to generation. Family homes and farms meant to build generational wealth and spur upward mobility: the creation of the middle class. If we are to lose this promise, then we are to lose what makes us American.

The History:

The economic history of this country shows one thing to be certainly true; the easiest pathway towards economic mobility and the acquisition of wealth is through the ownership of land. This promise was the Jeffersonian vision of what our country could be, one dominated by the yeoman (average, everyday) farmer. As America marched West and conquered land from sea to shining sea, the government took land from the Native Americans and redistributed it to mostly white American farmers through a series of policies known as the Homestead Acts. The most transformative measure was The Homestead Act of 1862, which redistributed 270 million acres of farmland to western settlers.

While it is important to acknowledge that the U.S. government took the land from Native Americans and that the government generally barred African-Americans from gaining access, the various Homestead Acts of the 19th century radically altered what was possible for poor white Americans. Access to 160 acres of free or below market rate arable farmland allowed white Americans who had nothing to grow their wealth by improving the land the government had granted them. This free land would in turn be passed onto their children who would continue family farms. This cycle created a vibrant and competitive economy. The ensuing generations would reap the wealth of the land and use it to climb the economic ladder into the American middle class.

A similar, arguably more popular, policy adopted in the 20th century took the idea of land ownership and granted it to even more predominantly white Americans. The GI Bill granted World War Two veterans, a group that spanned across class lines, access to affordable suburban housing. In an almost identical story to the family farm, the family home could be passed on from generation to generation as the land grew in value. The descendants of GI Bill recipients would be able to mortgage their land to start new businesses, send their kids to higher education, or sell the land for profit if they wanted to.

The mass acquisition of land allowed poor Americans to generate their own wealth, create a vibrant and competitive economy, and create the Middle Class that we know today. Access to land was the primary pathway for millions to get out of poverty in this country. Denied access to this land was the primary pathway toward systemic poverty for minority populations within America. By understanding the power and possibility of land ownership one can see why it is so important that American land stays in American hands.

The Housing Problem:

Significant economic policy reform took place in the late 90s and 2000s that loosened restrictions on banks and allowed them to run wild in a way not seen since the eve of the Great Depression. The Federal Reserve’s response to the 2008 Financial crisis ushered in an era of cheap money and free-flowing capital that Wall Street thrived on. As a result, the private equity sphere boomed. With a decade’s worth of cheap money flowing through Wall Street and few regulations to stop the practice, private equity groups like Blackstone have acquired tens of thousands of American homes.

This shift was possible because Blackstone and groups like them were able to offer above asking price in cash, something that is extremely attractive to both banks and real estate agents. There is no risk involved for those selling the property since they are being paid in full upfront. Most Americans are unable to afford the price of housing outright, so they must save up for a down payment that covers part of the cost while the rest is paid off in a mortgage that typically lasts multiple decades. This system puts banks at some level of financial risk, something highlighted in the 2008 recession.

The private equity groups are willing to make these investments in part because they have the extra cash thanks to quantitative easing (a central bank technique for increasing cash flow into Wall Street to stimulate spending) and in part because renting out housing creates long-term cash flows for the company. The rental cash flow is of course coming from American families paying rent to the private equity groups. Since the implementation of QE in 2010, hundreds of thousands of single-family properties have been bought up by these institutional investors, a group that represented almost 0% of the single-family rental market before 2010 but now represents up to 30% of the market.

It certainly does not help that current federal policy, geared toward lowering inflation, is raising interest rates and causing mortgage payments to rise. Since most Americans judge affordability based on mortgage payments instead of the total cost, something they could never afford outright, the increase means fewer Americans will be willing or able to buy housing. If there is less demand for housing, the overall home price will decrease. For a private equity firm that is looking to pay in cash and needs a safe stream of revenue due to interest rate spikes, buying up homes makes all the more sense.

The problem is twofold: on one hand, American families are blocked out from the housing market and on the other hand, as a result of being blocked out, wealth is generated for Wall Street instead of the American family. Upward mobility and generational wealth will become untenable on a mass scale. The thinning out of the middle class will be expedited as more and more Americans become locked out of the market. Entrepenurialship will drop as Americans will be unable to start new businesses since they lack property to mortgage. The decline in new businesses will further hurt the economy by both decreasing potential competition and depriving communities of local small businesses.

Despite the dire predictions, this downward spiral is all easily avoidable. Like the great land distribution policies of the 19th and 20th centuries, the government can once again step in to ensure Americans have the opportunity to own their own home and a chance at economic mobility. Ban Wall Street firms and private equity groups from buying American housing. The solution is as simple as that. For those who deem the policy as radical, legislate a priority system. Allow a grace period where Wall Street firms are barred from buying housing. If no individual is able or willing to buy a given home during the grace period, then Wall Street firms will be given the opportunity. However, if we want to ensure that housing stays in the hands of American families and not private equity firms, then we shouldn’t give Wall Street a chance in the first place.

The Farmland Problem:

The consolidation of American farmland over the past 50 years has turned the family farm into a creature on the brink of extinction. This transformation is economically frightening in its own right; the centralization of our farmlands is currently causing all of the negative effects associated with anti-competitive industries. It is estimated that farms with over $1 million in yearly sales represented 51% of the value of U.S. farm production in 2015 compared to just 31% in 1991. A share hold that has been steadily growing since the early 1980s and continues to expand today.

In addition to the issue of monopoly, there is a growing national security threat being presented in the form of foreign influence. Multinational corporations hailing from outside the U.S. are buying up American farmland and are contributing to the oligopoly. This threat comes chiefly from China, America’s primary foreign adversary, and the corporations operating on behalf of the nation.

The issue of centralization and anti-competitiveness is compounded by the national security risk posed by foreign nations. The simple question is this: does allowing a foreign adversary to own the means of American food production make sense? The answer is easily no. Why would we give another country, let alone China, control over the American food supply? The same sentiment goes toward every foreign nation that owns American farmland. Our domestic food supply chains are domestic for a reason, to remain self-sustainable during times of conflict. Giving up this important strategic advantage weakens America’s hand when it is forced to confront hostile foreign actors on the world stage.

Once again this problem is easily avoidable and only requires a blast from the past. As recently as 2013 some states did not allow foreign ownership of farmland. This practice was once commonplace but has since been rolled back during the era of neoliberal globalization. If America were to simply ban the foreign ownership of American farmland, our nation would be able to revert back to the past and increase national security.

Multiple attempts have been made at the state and federal level from a push to ban the practice in California that was ultimately vetoed by Governor Newsom to legislation introduced by Rep. Dan Newhouse (R-WA) that died in the house due to fears of xenophobia. Since states cannot be trusted to pass legislation on their own, the duty falls to congress. Here a bill must be crafted that appeases the concerns of liberals worried about xenophobia while still being strong enough to protect the nation’s food supply chains. The best course of action would be to pass a blanket ban on all foreign entities from owning American farmland.

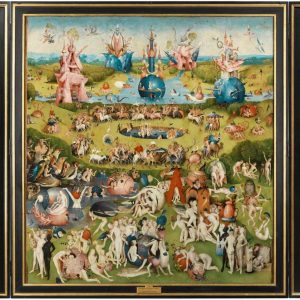

Featured Image: EmmaJ

Comments are closed.