A Puzzling Return

Elon Musk’s decision to open a new Tesla global engineering headquarters in Palo Alto at the former site of Hewlett Packard in February 2023 may have raised some eyebrows. After all, just 16 months before, the controversial tech billionaire moved the headquarters of the California-founded company to Austin, Texas.

That move came after Tesla gained publicity for filing a lawsuit against Alameda County over the reopening of the company’s flagship manufacturing plant in Fremont during the COVID-19 pandemic. The official explanation was that restrictive housing prices forced the company to leave the Bay Area, but it’s tough to imagine that conflicts with state officials didn’t play a part. One blog post alleged that the move was a response to an insult tweeted by a CA Assemblywoman towards Musk in May 2020, which Musk seemed to confirm. Texas Governor Greg Abbott further obfuscated the situation by claiming that Musk was partial to the “social policies” in his state.

Whatever the reason for the initial move, Musk’s antagonistic rhetoric towards California didn’t cool down after he left the state. In a 2022 podcast appearance, he referred to it as a “land of taxes, over-regulation, and litigation.” Ironically, it is those same tax and regulatory policies that have kept Tesla solvent and stimulated demand for their vehicles for decades. In spite of his obvious disdain for the state, Musk has retained support at the top of California politics, enabling Tesla’s abrupt return.

Tesla: A California Company

Tesla was founded in 2003 in San Ramon, CA by a pair of Silicon Valley engineers, but the vision for a fully electric car manufacturer took a while to get off the ground. California’s Zero-Emission Vehicle Program, a policy pioneered by the state Air Resources Board in 1990, was vital to the early success of the company by allowing Tesla to sell emissions credits to other car manufacturers that had failed to meet electric vehicle quotas.

In 2009, Tesla narrowly avoided bankruptcy but was able to bounce back and increase production after it purchased Toyota’s auto factory in Fremont in exchange for stock the following year. In 2022, that same Fremont plant was named the most productive automotive manufacturer site in North America for the previous year by a Bloomberg study.

Electrifying California’s Roads

Given the contentious nature of Tesla’s withdrawal from California, it may have surprised many to see Musk publicly announce the company’s return with California Governor Gavin Newsom by his side. Newsom has been a Tesla fan for decades and was one of the first people to purchase a Tesla Roadster in 2007. Since then, he’s maintained a friendly relationship with Musk and has been at the forefront of the drive to support electric vehicle adoption.

Newsom received a lot of publicity for his commitment to making 100% of the cars sold in California zero-emissions vehicles (ZEVs) by 2035, and his stance represents an extension of decades of pro-EV policies in California that provide subsidies and other incentives to EV purchasers. These include the Clean Vehicle Rebate Program (CRVP), through which applicants can receive up to $7,500 for purchasing a ZEV, and Clean Air Vehicle Decals which allow drivers of clean air vehicles to use the carpool without passengers.

These programs have made a big impact with over a trillion dollars in total CVRP dispersal, over two-thirds of which has gone to battery-operated vehicles–the classification that includes Teslas. In fact, about half of CVRP recipients indicate that they wouldn’t have purchased or leased their plug-in electric vehicle without the rebate.

State funding for electric vehicle programs has pushed more people to purchase them over the last few decades, and that’s something that should be celebrated. A recent study from USC Health Science found that early ZEV adoption in CA has already had a positive impact on air quality and asthma hospitalization. However, a significant “adoption gap” was identified with a slower growth rate in the number of ZEVs in zip codes with lower educational attainment. California needs to make increasing ZEV adoption rates among people of lower socioeconomic status a primary goal to ensure the public health benefits of reduced emissions are equitably distributed.

Where do Benefits Go?

Much of California’s funding for EVs has disproportionately supported Tesla, by far the largest electric vehicle manufacturer and supplier in the state. Almost 40% of CVRP funding has gone towards purchases of Tesla vehicles. Since Tesla only produces ZEVs, it also profits from the aforementioned ZEV credit program far more than any other automaker. In total, the company has received an estimated $3.2 billion in direct and indirect subsidies from the state of California since its founding.

And all that funding has stimulated a high demand for Teslas in California. Anyone who’s walked through an office park in San Jose or Irvine can attest to the massive popularity of Tesla vehicles among a certain contingent in the state. And these observations are backed up by the California New Car Dealers Association Impact Report, which found that the Tesla Model Y and 3 were the best-selling cars in California in 2022. The company also held a whopping 73% of the state’s battery electric market share in that year.

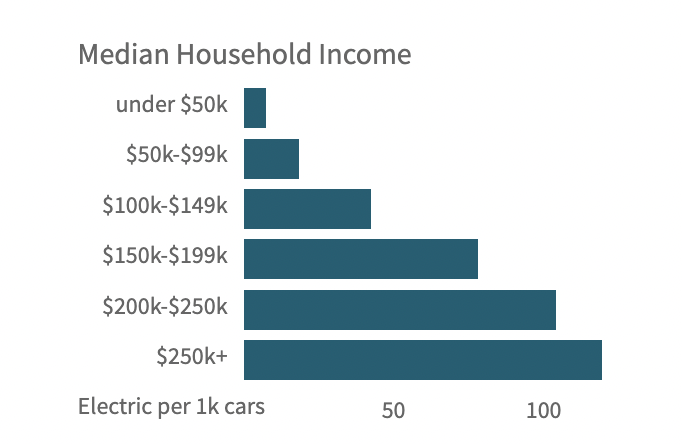

Clearly, there’s a huge market for Teslas in California, but who exactly does that include? It’s not entirely surprising that the average income of a Tesla Model S owner was $151,096 in 2022. By contrast, the income of an average California household during this period was $41,276.

One would hope that primarily middle and lower-income families in California for whom electric vehicles are cost-prohibitive would benefit from state policies that make them more affordable, but that hasn’t been the case. Only 30% of CVRP rebates issued in 2017-20 went to Californians with self-reported income below $100,000, and for Tesla purchasers, this value is just 25%.

Who is Left Behind?

Census data shows that CA ZIP codes with a median income below $100k and those in which a minority of residents have bachelor’s degrees lag far behind richer areas in EV frequency. Rural areas are also being left out, possibly due to a lack of charging infrastructure.

In response to this adoption gap, the CA Air Resources Board created the Clean Cars 4 All program, which provides grants for low-income and disadvantaged community residents to replace an older ICE vehicle with a clean vehicle or other transport option. However, CC4A grants cover only a fraction of a percent of total ZEV sales in CA, and their proliferation hasn’t increased much throughout the lifetime of the program. A 2021 analysis of equity in CC4A implementation found that the program has been consistently underfunded since its creation in 2015, and routine exhaustion of funds leads to long waiting lists and inconsistent availability of grants.

Despite massive spending on EV promotion, California simply isn’t doing enough to support low and middle-income families in transitioning to zero-emission vehicles, and the reliance on Tesla to spearhead the California EV industry certainly isn’t helping.

The average Tesla purchased in June 2022 cost $68,392, more than the average EV and far more than most Californians can afford even with rebates. Tesla has spent taxpayer money designing flashy vehicles like the Cybertruck, developing autopilot software, and enhancing the “luxury” appeal of their cars, none of which have helped the average consumer.

Increasing the Reach of Electric Vehicles

Increasing the availability of public charging infrastructure is crucial to pushing more drivers to switch to EVs, as evidenced by recent trends in public funding. In February, the US Department of Energy allocated $7.4 billion in funding for chargers in several states. This announcement included a deal with Tesla to make 7,500 chargers of their chargers—usable only by proprietary vehicles up until this point—available to non-Tesla drivers by the end of 2024. The California Energy Commission also recently passed $2.9 billion for clean transport infrastructure, which it projects will double the number of EV chargers in the state.

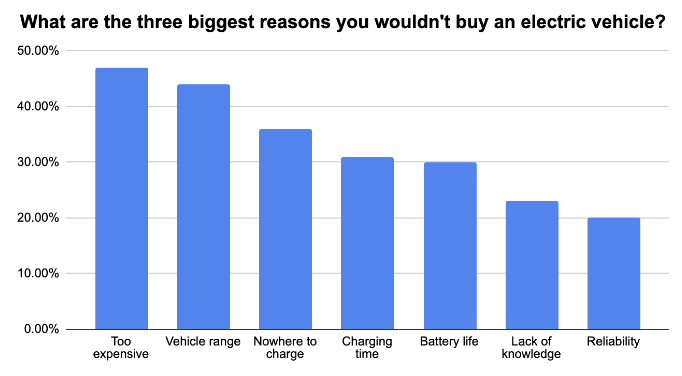

Increasing the proliferation and accessibility of chargers will be impactful in convincing hesitant consumers to go electric. After high prices, current car shoppers listed worries about vehicle range and insufficient local charging stations as the most common reasons they wouldn’t buy an EV. Concerns about charging infrastructure were particularly prominent among disadvantaged community members in California.

Tesla Superchargers offer reliable-multi car stations with faster charging speeds in high-traffic areas around the country, so opening them up would go a long way in powering California’s EV fleet. Opening up Tesla Superchargers would increase public EV ports in California by about 10%, which doesn’t include the 557 destination chargers across the state.

In the face of Tesla’s purported desire to open their Supercharger network, as of April only 2/309 supercharges in CA can be used by non-Tesla drivers. That number may eventually increase, but each day that Tesla delays is another day with more carbon-emitting vehicles on US roads than there should be.

Tesla has also faced pressure from California to open up its charging network. A state program devoted to clean transport in rural areas offered the company $6 million to build a total of 420 Supercharger ports, which Tesla turned down citing “cumbersome payment infrastructure requirements.” Tesla has happily accepted gifts from California for decades, but it seems they’re only willing to invest in projects that benefit those who can purchase their cars.

Paving the Way for EV Equity

Musk’s ingratitude for the government policies that keep his company afloat hasn’t dissipated since he crawled back to the Bay. In April he claimed that Tesla “doesn’t require subsidies,” a statement that’s especially ludicrous considering the company’s recent actions. Since the start of the year, Tesla has reduced US prices on its various models at least five separate times, with reductions totaling up to 20%. These price cuts come in anticipation of further requirements that will reduce federal tax credits for Teslas purchased in 2023. The message: federal and state subsidies to EV buyers are an incentive that the company can’t afford to lose.

In his press event alongside Elon Musk, Governor Newsom applauded California’s success in growing not just Tesla, but a total of 44 EV manufacturers in the state. He cited this as an example of California’s culture of innovative entrepreneurialism, but sinking money into experimental automobile technology isn’t necessary when electric cars have been around since the 19th century. Instead of funding high-end EV startups, California money would be better spent on supporting existing automakers in developing and marketing EVs that people can actually afford.

If Newsom is serious about increasing competition in the CA electric car industry, ditching internal combustion engines on a large scale, and making sure zero emissions vehicles are accessible for every Californian, he’ll stop playing nice with his buddy Musk. That means increasing pressure on Tesla to integrate their charging stations, subsidizing the production and sales of affordable ZEVs by legacy auto manufacturers, and increasing the scale of programs like Clean Cars 4 All. Tesla has benefited from California policy enough, and it’s high time California taxpayers saw returns on their investment.

Featured Image Source: KRON4

Comments are closed.